TL;DR

Over the next 10–15 years, a massive transfer of business ownership is underway as Baby Boomer entrepreneurs retire. Roughly 70% of privately held businesses may change hands, representing trillions in value.

Yet the majority of these owners lack formal exit plans and are unprepared for clean transitions.

For first-time buyers, this presents a rare window: less competition, more deals, and the freedom to pick and shape value. But it demands rigorous due diligence, an understanding of succession risk, and the ability to structure win-win deals.

This article gives you data, dangerous blind spots, and a step-by-step framework to act in this moment—not wait on it.

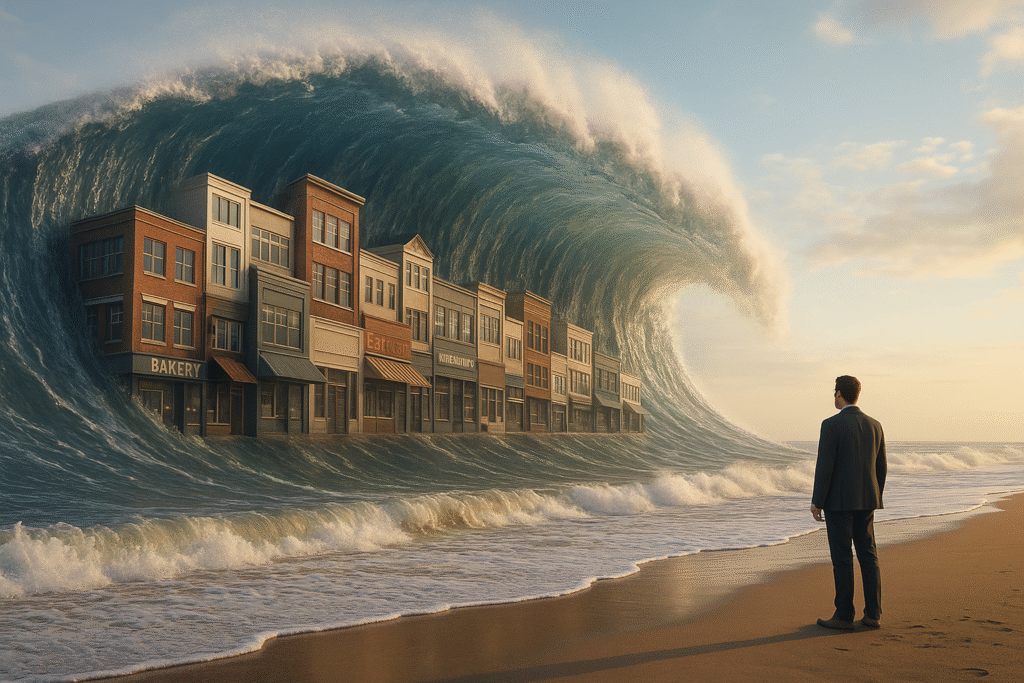

The Trillion-Dollar Silver Tsunami: Why This Decade Is Your Moment to Buy a Business

We often talk about venture capital, tech disruption, or “the next big thing.” But right now there’s a quieter, more certain wave about to reshape business ownership in America. It’s the tidal shift of retiring Baby Boomers handing off enterprises they built over decades.

Over the next 10–15 years, approximately 8 to 10 million privately held businesses—more than 70% of today’s privately held companies—are likely to change ownership (Headway Exec). The value of those businesses is measured in trillions (IT ExchangeNet).

That’s the silver tsunami. If you’re a first-time buyer, this is blood in the water. But this isn’t “get rich fast”—if you jump in without discipline, you’ll lose. You need to see the risks, know what to look for, and move deliberately.

Here’s what you need to understand:

- There are 2.9 million U.S. businesses owned by individuals over 55, generating roughly $6.5 trillion in revenue (Project Equity).

- Yet only 13% of business owners have a formal exit plan, and just 5% of Boomers have assembled a full advisory team (Succession Plus).

- In fact, 41% of small businesses (revenues between $100K–$25M) expect to transition within 5 years, but many admit they’ll close if no buyer shows up (Kiplinger).

- Venture capital is already circling these opportunities, eyeing the wave of sellers with no successors and positioning new buyers as the builders of the future (Forbes).

What This Means for First-Time Buyers

This is not just a wave of “businesses for sale.” It’s a structural shift. If you as a buyer understand these dynamics, you can:

- Pick higher upside deals — lower multiples, overlooked “orphan” small businesses

- Negotiate smarter — use latent risk (succession, transition) to structure earn-outs, contingent payments

- Build lasting value — buy not just cash flow, but the ability to upgrade systems, professionalize, reduce founder dependency

- Be selective — not every business is worth buying. Many are ticking time bombs.

But pitfalls are real. Let me walk you through a framework to act safely.

| Step | What to Watch For | Why It Matters | Key Questions / Actions |

|---|---|---|---|

| 1. Filter for owner dependence risk | How much of day-to-day and customer relationships are tied to the owner? | If the owner leaves, the business must survive | Ask for client continuity, recurring contracts, documented systems |

| 2. Assess internal succession viability | Is there a family, employee or leadership team who can carry it forward? | If not, risk of collapse post-exit | Meet the next gen, check motivation, capacity, training |

| 3. Clean financials + valuation rigor | Many sellers don’t have clean, audited books | You don’t want surprises during due diligence | Demand 3–5 years of P&L, cash flow, owner’s adjustments |

| 4. Deal structuring that shares risk | Use earn-outs, seller financing, escrow, milestone payments | Mitigates your downside if the business stumbles | Build in performance-based payments, retention clauses |

| 5. Build a transition playbook early | Who takes over what, how relationships shift, how culture evolves | The handoff is often where deals fail | Document onboarding, customer communications, team roles |

| 6. Plan your post-acquisition growth path | You’re buying legacy; you need your own strategy | Many buyers fail because they lack roadmap | Identify 2–3 levers: digital, operational efficiency, new markets |

Risk Zones & Red Flags

- No documented systems — owner emails, spreadsheets, “tribal knowledge”

- Single big client tied to the owner — when owner leaves, that client leaves

- Emotional sellers — often overvalue, push for unfavorable terms

- Undocumented liabilities — pending lawsuits, tax issues, leases

- Lack of depth in the team — if key employees leave at switch time

Case Example (Hypothetical)

Imagine a regional HVAC business run by a founder for 25 years. He has stable cash flow but has never documented SOPs. He’s discussing retirement and lacks a successor. Without a buyer, it may shut down, customers may migrate, employees may disperse.

You approach it. You negotiate an earn-out: you pay a base, then additional payments contingent upon revenue retention over 2 years. You invest in professionalizing operations, put CRM systems in place, offer retention bonuses to key technicians. Over 3 years, you double efficiency, diversify into commercial accounts.

You essentially buy a legacy asset and turn it into a more scalable, repeatable machine.

What You Should Do—Now (Before Everyone Figures This Out)

- Get serious about deal sourcing now. The early mover wins.

- Build your evaluation checklist tailored to transition risk, not just cash flow multiples.

- Plug your network — accountants, attorneys, business brokers who know succession.

- Learn structure tools — earn-outs, performance escrows, seller financing.

- Run small “proof deals” — don’t stretch for “the perfect one.”

- Be ready to walk away — many deals will fail your bar. That’s part of filtering.

Conclusion

This decade offers you a rare alignment of economics, demographics, and buyer demand. The silver tsunami is real. But it will reward those who show up ready—disciplined in diligence, clear in structure, and strategic in post-deal growth.

Stay sharp. Think long. And be in a position to act before the herd catches wind.

Join us at BusinessOwner.com