TL;DR — BizBuySell Q2 2025 (Buyer Leverage Returns)

- Deals slowed: 2,342 businesses sold (↓ 4% YoY).

- Prices softened: median sale price $352K (↓ 6% YoY); total deal value ↓ 4%.

- Lending tighter: SBA rules cap seller notes at 50% of buyer equity and put them on full standby; average time-on-market +12 days.

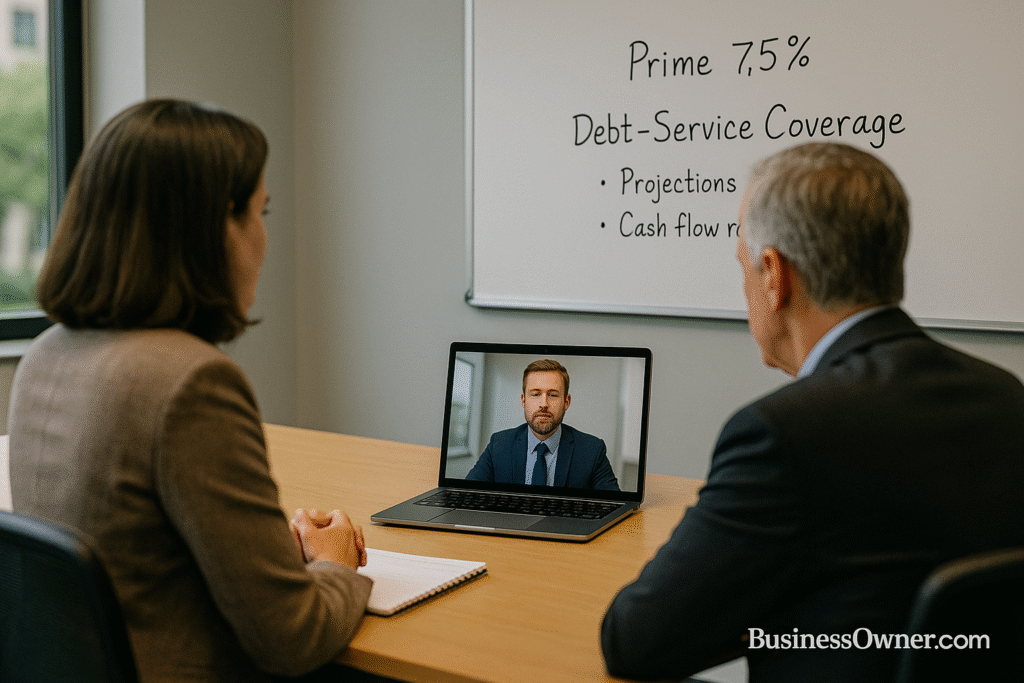

- Rates still bite: plan around prime ≈ 7.5%.

- Shift in demand: buyers favor smaller, recession-resistant service businesses.

- Playbook now: tight criteria, pre-underwrite with SBA lenders, move fast on stale/repriced listings, use seller notes as supplemental, not as the equity injection.

The business‑for‑sale market cooled slightly in Q2 2025. According to BizBuySell’s Insight Report, transactions fell 4% year‑over‑year while sale prices dropped and buyers shifted toward less expensive deals . Here’s why conditions are improving for prepared buyers, and how to respond.

Market Highlights

- Transactions down: 2,342 businesses changed hands in Q2 2025, a 4% decline from the previous year .

- Prices softening: Total enterprise value fell 4%, and the median sale price dropped 6% to $352 K .

- Tighter lending: New SBA rules restrict seller notes to 50% of the buyer’s equity injection and require them to remain on standby . These changes have slowed deals and lengthened time‑on‑market by 12 days .

Why Buyers Have the Upper Hand

- Higher borrowing costs: With prime at roughly 7.5% , financing is expensive. Many sellers anchor to 2021–2022 valuations, but buyers armed with current data can negotiate lower prices.

- Inventory shift: Buyers are gravitating toward smaller, less risky deals, which pushes median sale prices down .

- Regulatory uncertainty: Tariffs and SBA changes create hesitation for less prepared buyers —opening a window for those with financing lined up.

How to Capitalize

- Define your criteria. Focus on recession‑resistant businesses with steady cash flow. BizBuySell notes that 73% of buyers now target essential services .

- Get pre‑underwritten. Tight SBA rules mean lenders want more documentation. Obtain prequalification and proof of funds before making offers .

- Act fast on price reductions. With deals taking longer, stale listings may be ripe for negotiation. Have your due‑diligence checklist ready so you can move quickly when a seller lowers the price.

Is Q2 2025 a buyer’s market?

Not entirely. Quality businesses with strong cash flow still command strong multiples. However, overall conditions—slower deal volume and lower prices—tilt leverage toward prepared buyers .

What sectors are buyers chasing?

BizBuySell data shows demand for recession‑resistant industries like home services and healthcare .

How can I handle new SBA rules?

Ensure you meet equity‑injection requirements with cash, then use seller notes as supplemental financing to avoid standby restrictions .

Conclusion & CTA

The Q2 2025 BizBuySell report signals a modest shift in favor of buyers—but only for those who are ready. The BusinessOwner.com Certified Buyer Program prepares you to underwrite deals, negotiate effectively, and leverage today’s softer prices. Our Ownership Agents help you source off‑market opportunities and avoid pitfalls.

- 2026 Business Mileage Deduction: New IRS Rate Explained

- Unlock More: Higher SBA Caps Could Open Bigger Buying Power

- The $1,000 Path That Builds Real Momentum

- How to Start a Business With No Money

- Why Most Startups Fail (And What It Says About You)

- AI Solution Search

- Blog

- Buy or Sell a Business

- Buyer Quiz

- Certified Business Owner Agents

- Certified Buyer Program

- Home

- Privacy Policy

- Terms of Service